Level-Up Your Legacy

With multifamily real estate investing

Roers Companies offers direct access to institutional-quality multifamily apartment investments. As a limited partner, you enjoy tax benefits while benefiting from our in-house expertise. Roers Cos.’ has made more than $2 billion in institutional-quality multifamily real estate projects accessible to individual investors, allowing investors to achieve an average net IRR of nearly 20%.

Why Invest in Multifamily Real Estate?

Strong Returns

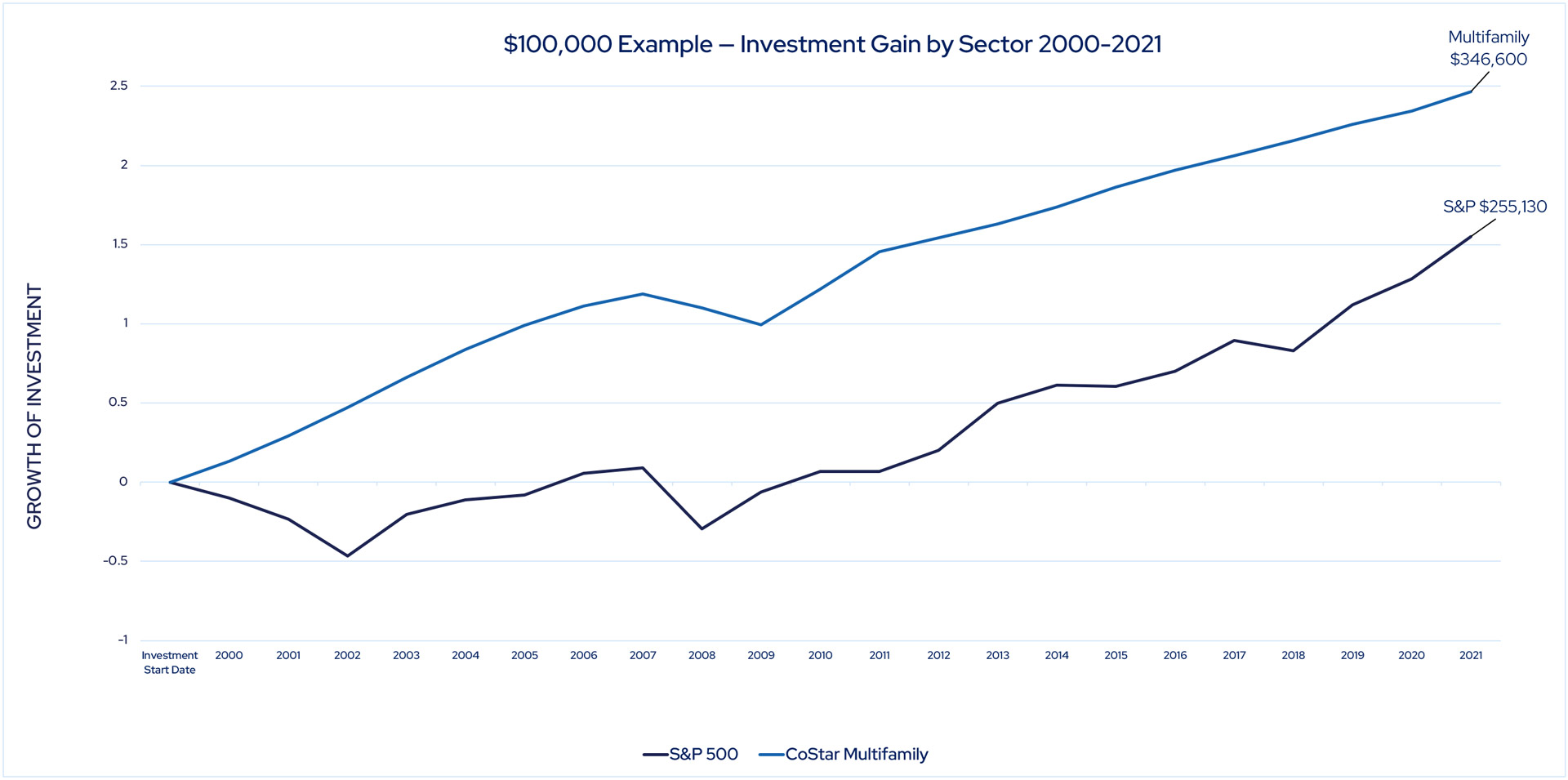

Private multifamily investments have historically outperformed bonds, public REITs, and even the S&P 500 when you review average annual returns since 2000.

Greater Stability

Because housing is a basic human need, multifamily has historically been more resilient than other investments during times of economic uncertainty, especially when comparing private multifamily developments to the volatility of public assets like stocks and REITs.

Tax Benefits

Real estate owners and limited-partnership investors can often capture unique tax advantages, particularly when investing in programs such as Opportunity Zones.

Diversification

Incorporating a mix of liquid and longer-term investments across multiple asset types can help insulate investors from downward-trending economic conditions — and prime market conditions can lead to incredible multifamily returns.

By The Numbers

13,000

Units built & under construction

$2.8 Billion

Developed since 2012

$550+ Million

Private equity raised

Our Returns*

15-20%

Targeted Internal Rate of Return

9-12%

Average Annual Cash on Cash Return During Operations

19.7%

Average Net IRR to the Investor

*Targeted refers to a goal that may or may not be attained based on a variety of assumptions that may or may not be realized. Securities are only available to verified accredited investors who can bear the loss of their investment.

Since 2012, Roers Cos investors have successfully funded 75 deals, 53 of which we’ve developed and leased up and 17 of which have realized (sold). As more deals work through their holding periods, these numbers will be updated quarterly to reflect the latest metrics, which are calculated to be net of fees. The last update was 4.2024.

Current Investment Opportunities

FAQs

What is Cash-on-Cash Return?

Sometimes referred to as the cash yield, “cash-on-cash” calculates the income earned on the dollars invested in a property.

What is IRR?

Internal rate of return (IRR) is the annualized return metric that calculates both cash flow and equity returned over the course of the entire holding period.

How is Roers Cos. 28.8% realized IRR calculated?

This number reflects the rate of return averaged across the 17 Roers Cos. projects that have been realized — i.e., projects that have gone full cycle from construction, to operations, to sale.

What is real estate syndication?

Real estate syndication is a partnership of investors who collectively buy larger assets that may be unmanageable or expensive for individual investors. Usually, 25–30% of funds originate from both the syndicator and passive investors, while 70–75% comes from a lender or bank.

What does accredited investor mean?

An accredited investor is someone who meets income and net worth criteria set by SEC regulations. Accredited investors are allowed to participate in investments not registered with the SEC.

To qualify:

- You need an annual income of $200,000, or $300,000 combined income for two years, with an expectation of maintaining or increasing it this year.

- Your net worth must exceed $1 million, excluding your primary residence.

How can I invest?

Self-directed IRA: Clients may have a large portion of their net worth locked up in retirement plans. You can work with a custodian to roll a portion of your retirement account into a self-directed IRA, allowing them to invest in real estate to diversify your retirement accounts. We have recommendations on groups to work with if you’re looking for a self-directed IRA custodian.

Traditional cash investment: Investing after-tax money allows you to take full advantage of the depreciation benefits of owning real estate – without the hassle of to becoming a landlord yourself.

1031: We can accept 1031 exchanges into our projects if you want to take real estate where you are an active owner and exchange into passive ownership through our opportunities. Our minimum equity investment for 1031s is $1 million.

Capital gains/opportunity zones: For clients who have generated a capital gain through the sale of stock, a business, or real estate, we offer projects in qualified opportunity zones. This allows investors to defer their tax payment and pay no taxes on the sale of our project.

What is the average holding period?

Our hold period varies. Typically, we target a hold period of 3–5 years, although some deals may target as long as 10 years. The hold period is defined as the time between when the underlying property is acquired and when that property is sold and its proceeds are distributed to investors.

What does investor communication look like?

Roers Cos. initiates regular communication with our investors and strives for transparency in all of our partnerships. Investors receive monthly construction updates via email, quarterly asset management updates once a property is open and operating, and bi-annual investment portfolio review meetings — either in-person or virtual — with our investor relations team. Additionally, investors have access to a secure portal to view investment returns, subscription agreements, taxes, and distributions.

When are distributions paid?

For any project that is distributing, we send out quarterly distributions via ACH along with our quarterly letter from the Roers Cos. asset management department.

Do you have more investment options?

We do! Roers Cos. investment advisors work with you to build a custom portfolio designed to fit your goals and needs. Contact us to set up a no-obligation introduction call to get started.

Investing With Roers Cos.

Request Information

Investment opportunities at Roers Cos. are continuously changing.

Please complete the form below to receive information about investment opportunities from Roers Cos.

NO OFFER OF SECURITIES; DISCLOSURE OF INTERESTS: Under no circumstances should any material on this website be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the confidential Private Placement Memorandum relating to the particular investment. Access to information about investments with projects undertaken by Roers Companies LLC, Roers Companies Project Holdings LLC, or any of their respective affiliates is limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who are generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments.

Investment outcomes vary. Past success does not guarantee future results.