Invest in Opportunity Zones

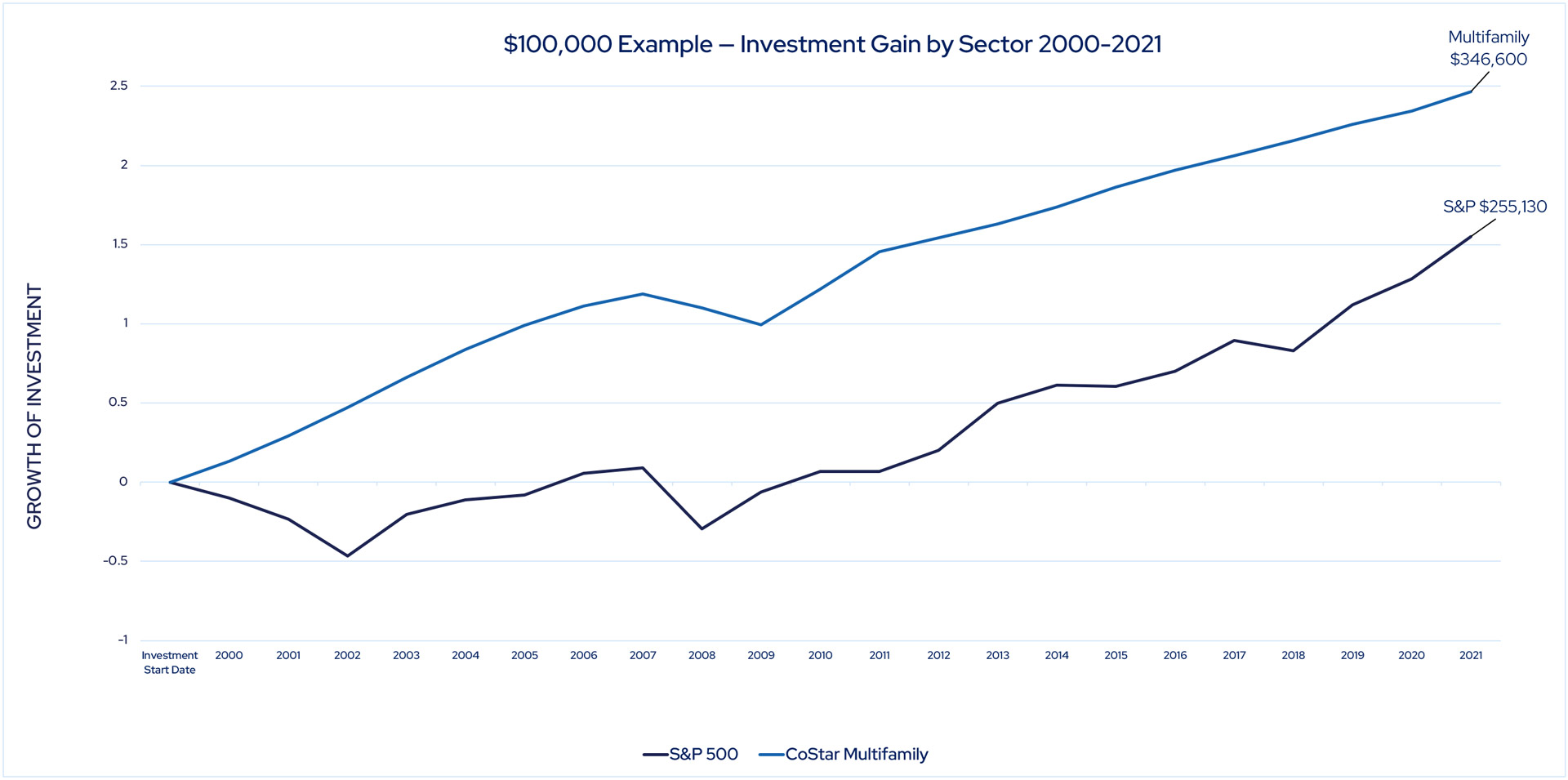

Roers Companies is a national real estate investment, development, construction, and property management company focused on the multifamily apartment sector. Our diverse in-house expertise enables us to conduct robust pre-project assessments and facilitates long-term asset performance. We’ve made more than $2 billion in institutional-quality multifamily real estate projects accessible to individual investors. In 2023, Roers Cos. ranked as one of the top 25 multifamily developers in the nation.

Opportunity Zones are an economic development tool that allows people to invest in up-and-coming communities. Their purpose is to spur economic growth and job creation while providing tax benefits to investors.

Tax Benefits of Investing in Opportunity Zones

Depreciation Deductions

- Significant depreciation deductions over the life of the project

- Deductions generally equal 100% or more of investor cash investment within 5 years of the building being placed in service

- Deductions generally around 3X an investor cash investment over the depreciable life of the building (30 years)

Depreciation Recapture

OZ investors get the same tax benefits from depreciation as any other market-rate project through the life of the deal, however, OZ investors do not need to recapture the depreciation as additional gains on a sale if held for 10 years – presenting a huge tax savings benefit.

Depreciation Losses

Losses generated by depreciation can shelter other sources of pass through income for investors on annual basis. Unused losses are also eligible to carry forward to future years.

Deferral of Capital Gains

Any gain treated as a capital gain (including 1031 gains) generated from a sale can be deferred until December 31, 2027 by investing in a QOF. Examples of capital gains eligible for investment in a QOF are: sale of a business, stock sales, and real estate sales.

Opportunity Zone Investment Timeline Example

Roers Companies’ projects are eligible for 1031/1231 exchanges and we can assist you with the necessary documentation. Investors have 180 days to invest the gain in a QOF.

Payoff of Invested Capital Gain of $1,000,000

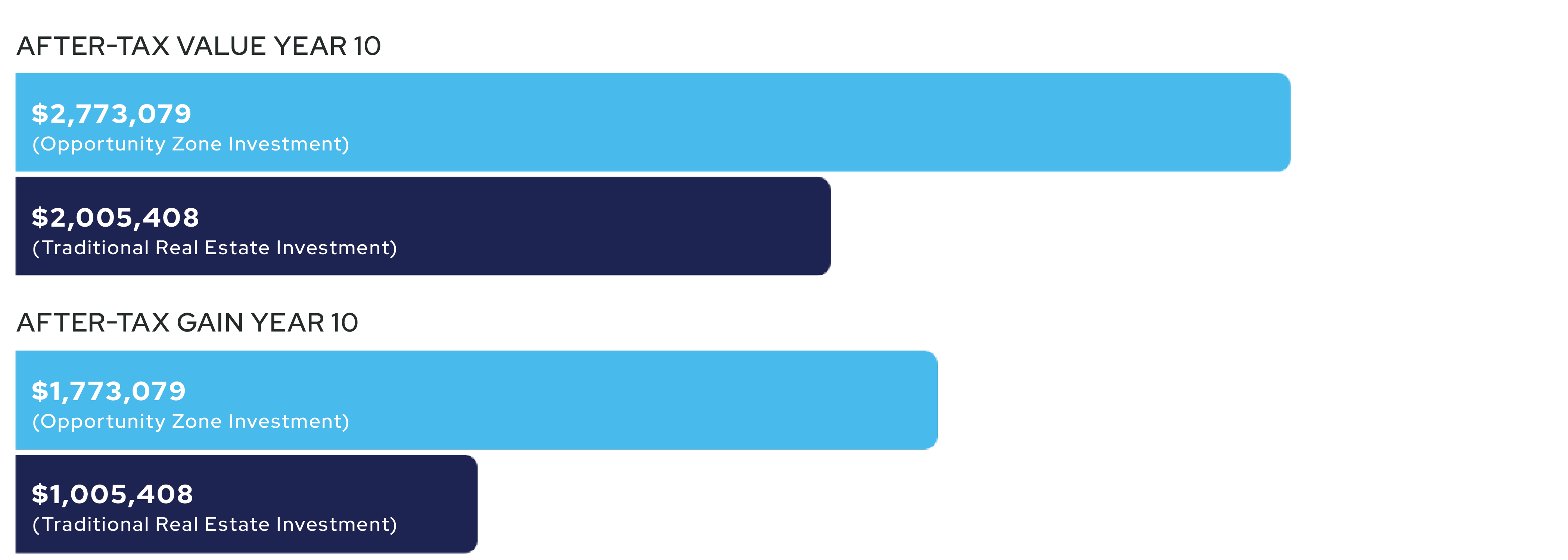

Opportunity Zone Investment vs. Traditional Real Estate Investment

Assumptions: QOZ investment is made in 2023 and held for 10 years; annual rate of investment appreciation of 12%; long-term capital gains tax rate of 23.8% Note: The amounts shown illustrate the tax benefits of QOZ investments prior to any fee structures. Rate of return used only for illustrative purposes to demonstrate taxation concepts.

Current Investment Opportunities

By The Numbers

13,000

Units built & under construction

$2.5 Billion

Developed since 2012

$550+ Million

Private equity raised

Our Returns*

15-20%

Targeted Internal Rate of Return

9-12%

Average Annual Cash on Cash Return During Operations

28%

Average Realized Gross IRR

*Targeted refers to a goal that may or may not be attained based on a variety of assumptions that may or may not be realized. Securities are only available to verified accredited investors who can bear the loss of their investment.

Since 2012, Roers Cos investors have successfully funded 82 deals, 62 of which we’ve developed and leased up and 17 of which have realized (sold). As more deals work through their holding periods, these numbers will be updated quarterly to reflect the latest metrics, which are calculated to be net of fees. The last update was 12.2023.

Tax-Free Gain

Investing in an up-and-coming qualified opportunity zone offers significant tax-deferral opportunities. If you hold your investment for 10 years, appreciation and gains on the project will be 100% tax free.

Request Information

Investment opportunities at Roers Cos. are continuously changing.

Please complete the form below to receive information about investment opportunities from Roers Cos.

NO OFFER OF SECURITIES; DISCLOSURE OF INTERESTS: Under no circumstances should any material on this website be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the confidential Private Placement Memorandum relating to the particular investment. Access to information about investments with projects undertaken by Roers Companies LLC, Roers Companies Project Holdings LLC, or any of their respective affiliates is limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who are generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments.

Investment outcomes vary. Past success does not guarantee future results.