Gen Z on the Move: How Changing Demographics Are Shaping Multifamily Demand

The landscape of the multifamily market is undergoing a significant shift as Generation Z — the generation born between the mid-1990s and early 2010s — enters adulthood. This generation is poised to become the driving force behind rental demand, fueled by their population boom, economic realities, and distinct lifestyle preferences.

Gen Z is a larger generation than Millennials — the generation born between 1981 and 1996 — at the same age. This translates to a massive influx of renters, putting pressure on existing rental stock and potentially driving up demand, especially in desirable locations.

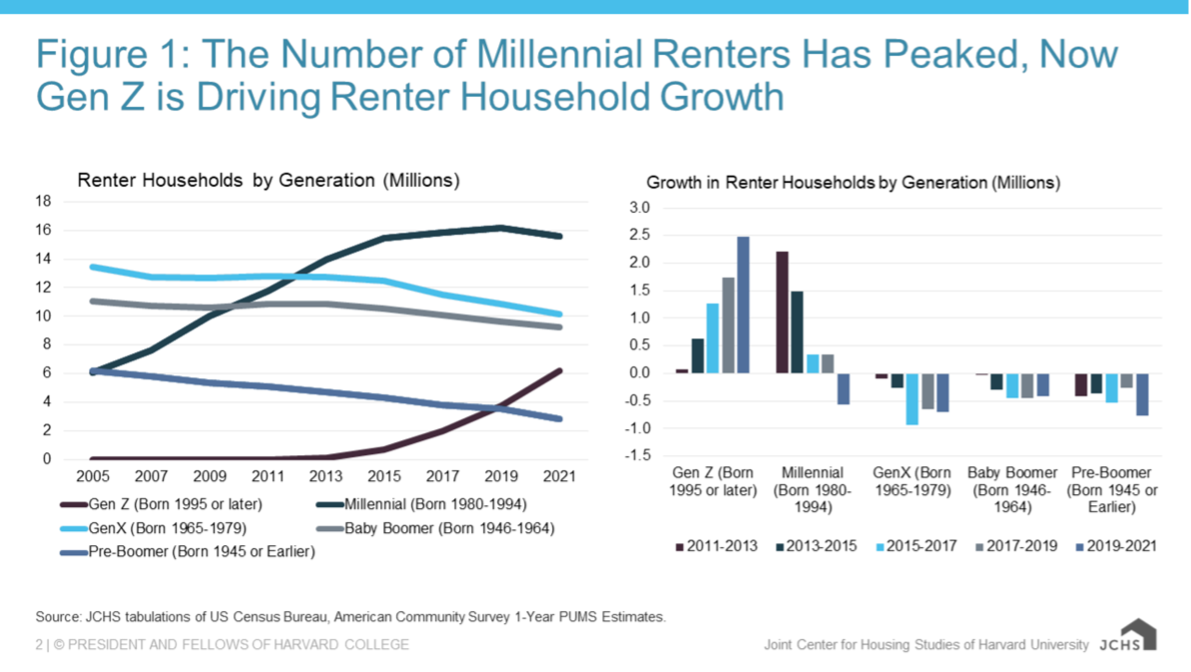

The trend of Millennials being the primary driving force behind rental market growth is lessening. As Millennials reach their late twenties to early forties, many are transitioning to homeownership, causing a decline in the number of renter households. Future rental market growth hinges on whether Gen Z can fill the gap left by departing Millennials. This means the number of new Gen Z renters in market-rate apartments needs to exceed the combined losses from older generations leaving rentals for homes.

Gen Z’s Preferences

Gen Z thrives in the vibrant energy of urban centers. They crave walkable environments where they can access shops, restaurants, and entertainment options on foot or with convenient public transportation. This proximity fosters a sense of community and connection, allowing them to easily meet friends, explore new areas, and participate in cultural events. Additionally, cities often offer a wider range of job opportunities in various industries, aligning with Gen Z’s desire for career flexibility and exploration.

The surge in rental demand among Gen Z is fueled by their sheer numbers and economic factors. Coupled with the burden of student loan debt and soaring housing costs, the dream of homeownership remains hard to attain for many — driving them towards the flexibility and cost-effectiveness that renting provides. This resonates perfectly with Gen Z’s emphasis on career flexibility and a preference for enriching experiences over traditional homeownership.

Renting is the more accessible and practical option for most of this generation. These combined factors paint a clear picture: Gen Z is a generation on the move, and their unique needs and preferences are reshaping the multifamily landscape.

Impact on the Multifamily Market

Gen Z craves unique experiences and expects brands to cater to their needs. This includes landlords, who need to adapt to this growing demographic. As Gen Z’s influence rises, multifamily owners must prioritize understanding their preferences for a successful future.

To attract and retain this tech-savvy generation, landlords and developers are adapting their offerings. This includes incorporating tech-enabled amenities like smart locks, online rent payments, and self-guided and virtual tours. Additionally, they are creating community spaces to foster connections and shared experiences, catering to Gen Z’s desire for social interaction and a sense of belonging. Understanding and catering to the evolving needs of different generations is crucial for the industry’s success. Landlords and developers are taking note, catering to Gen Z’s preferences for tech-enabled amenities, community spaces, and walkable locations.

While the exact impact on rental prices and occupancy remains to be seen, Gen Z’s growing presence is undoubtedly influencing the market.

How Roers Companies is Responding to the Gen Z Shift

Roers Cos. is closely watching the rise of Gen Z renters to navigate future of multifamily investments. This growing generation represents a massive influx of potential renters, significantly impacting market demand and shaping decisions about locations, amenities, and features within the firm’s portfolio. Designated remote-work amenity spaces — common in most Roers Cos. properties since 2020 — are one example of this shift.

Adapting to Gen Z’s preferences goes beyond just attracting new renters; it’s crucial for long-term success. High turnover erodes profitability. By creating a living environment that aligns with Gen Z’s values, Roers Cos. can foster higher resident satisfaction and lower vacancy rates. Staying up-to-date on changing demographics allows Roers Cos. to make informed investment decisions, ensuring the long-term viability and profitability of their multifamily properties.

To learn more about Roers Cos.’ properties and potential investment opportunities, please contact our investor relations team or visit our website.

NO OFFER OF SECURITIES; DISCLOSURE OF INTERESTS: Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment. Access to information about investments with projects undertaken by Roers Companies LLC, Roers Companies Project Holdings LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results.

Current Investment Opportunities

Investment opportunities for new multifamily projects are now open.