Debunking 5 Common Housing Market Myths

Roers Companies is often asked, “Why build now? What about interest rates? Inflation? The looming recession? …” Well, we’re seeing a ton of opportunity in spite of and even because of market factors.

Myth #1

High Interest Rates Make Multifamily Project Financing Impossible

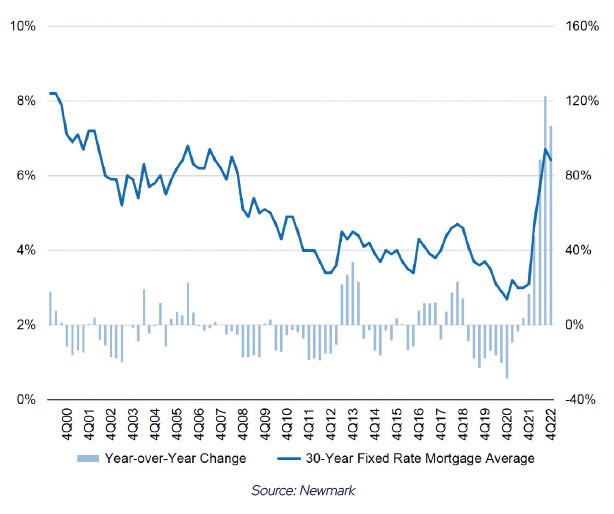

Interest rates are spelling trouble for single-family homebuyers. Mortgage applications for single-family homes are down more than 60% year-over-year. But do high interest rates always spell trouble for multifamily developers?

30-Year Fixed Rate Mortgage Average

How does this impact Roers Cos.?

On a recent project, the lender increased our rate from the 5.5% we had originally agreed on to 6.0% — a $500,000 hit to our budget. We chose to move ahead at the higher rate.

Why? As the project general contractor, we were in a prime position to navigate seasonal and market shifts. We’ve already garnered more than $1 million in construction cost savings — more than making up for the increased interest cost.

Roers Cos.’ vertically integrated company — with investment, development, construction, and property management under one roof — puts us in a better financial position on each project we build.

Roers Companies is often asked, “Why build now? What about interest rates? Inflation? The looming recession? …” Well, we’re seeing a ton of opportunity in spite of and even because of market factors.

Myth #2

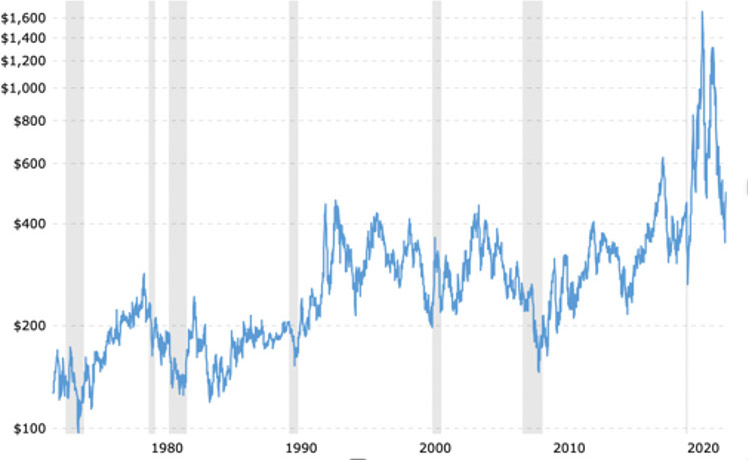

Inflation & Material Costs Are Historically High

We often hear “It must cost a fortune to build right now.” In fact, material and labor costs are down significantly compared to peak pricing during the past 18 months. Homebuilders’ slowdown means more competition among sub-contractors and suppliers on our multifamily jobs, which drives down our labor costs across multiple trades and balances out higher costs in other areas.?

Lumber is down 70%

Aluminum is down 40%

Steel is down 20%

Source: Macrotrends

Lumber Prices – 50 Years Historical Chart

How does this impact Roers Cos.?

Our general contracting team is finding that material and labor costs on our projects have plateaued. In other words, the impact inflation is having on consumers is not translating to the multifamily development market.

Myth #3

Apartments Are Being Overbuilt

Many members of the public assume that apartment developers are overbuilding. In contrast, research from Freddie Mac actually shows that the U.S. is still short in housing units, and prospective homebuyers are being priced out. The steep rise in monthly mortgage interest rates over the past 18 months from 3.5% to 6.5% translates to roughly 15 million fewer households able to afford a single-family home purchase today.

3.8 Million housing units currently short of demand

6.5 Million housing units the shortfall will grow to by 2030

5 Million fewer people can afford a home every 1% increase in mortgage rates

1 Million fewer people can afford a home every $10,000 increase in home prices

The demand for multifamily housing isn’t going away. Our development vetting process

shows strong projected financial fundamentals for each of our planned projects.

Myth #4

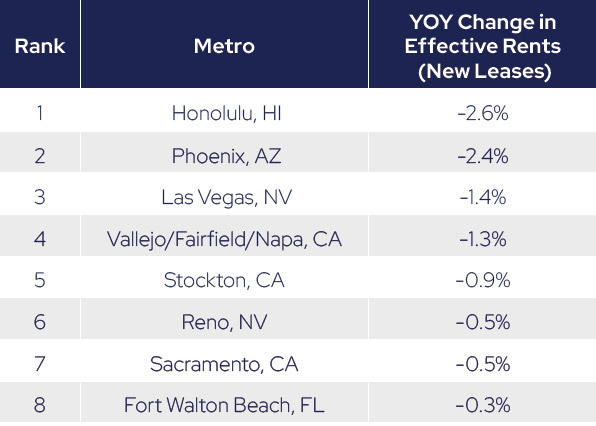

Multifamily is in Trouble Because Rent Prices Are Dropping

According to RealPage data from March 2023, just eight out of 150 metro area markets in the U.S. are seeing year-over-year rent declines. While rent growth nationwide is cooling compared to historic highs seen in 2021 and early 2022, rental rates remain strong.

Apartment Rents Fell YoY in 8 U.S. Metros

How does this impact Roers Cos.?

Apartment rents in the vast majority of U.S. markets continue to grow at or above the

conservative 3% we model in the majority of our Roers Cos. project proformas. In other words, rental rates remain aligned with our projections.

Myth #5

With a Recession Imminent, This Is a Bad Time to Develop Real Estate

There are myriad headlines today about real estate developers hitting pause on projects because of market uncertainty. Ultimately, this means fewer new multifamily buildings will be opening their doors in the next 18–24 months. As new apartment supply wanes, demand will rise. Many would-be homebuyers will remain in rental housing because mortgage interest rate hikes have a greater impact on their monthly budgets than rental rate increases.

How does this impact Roers Cos.?

Roers Cos. plans to start 20 new projects in 2023. The projects we break ground on in the coming months will be opening their doors and collecting rent by the time many others re-start paused projects.

Current as 05/20/2023

NO OFFER OF SECURITIES; DISCLOSURE OF INTERESTS: Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment. Access to information about investments with projects undertaken by Roers Companies LLC, Roers Companies Project Holdings LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results. Historical return details available.

The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Current Investment Opportunities

Investment opportunities for new multifamily projects are now open.