The 2025 Real Estate Market: Demand, Supply, and What Lies Ahead

As we look ahead to 2025, key indicators suggest that the real estate market is undergoing notable shifts. Carl Whitaker, Chief Economist at RealPage, recently shared his insights on the state of the national economy and its influence on the apartment market during a webinar with the Roers Companies Investor Relations team. His analysis highlights changing demand drivers, the evolving relationship between job growth and rent growth, and the impact of supply fluctuations on rental market fundamentals.

Demand Drivers: Beyond Job Growth

For years, job growth has been the leading indicator of apartment demand. However, Whitaker argues that this relationship has weakened in recent years. Historically, job growth was closely aligned with rent growth, but this correlation has diminished since 2020. Several factors contribute to this shift, including lingering effects from the COVID-19 era and the rise of remote work.

When companies hire remote workers from other locations, traditional job growth metrics become less reflective of local rental demand. As a result, industry professionals now need to look beyond job numbers when assessing market trends.

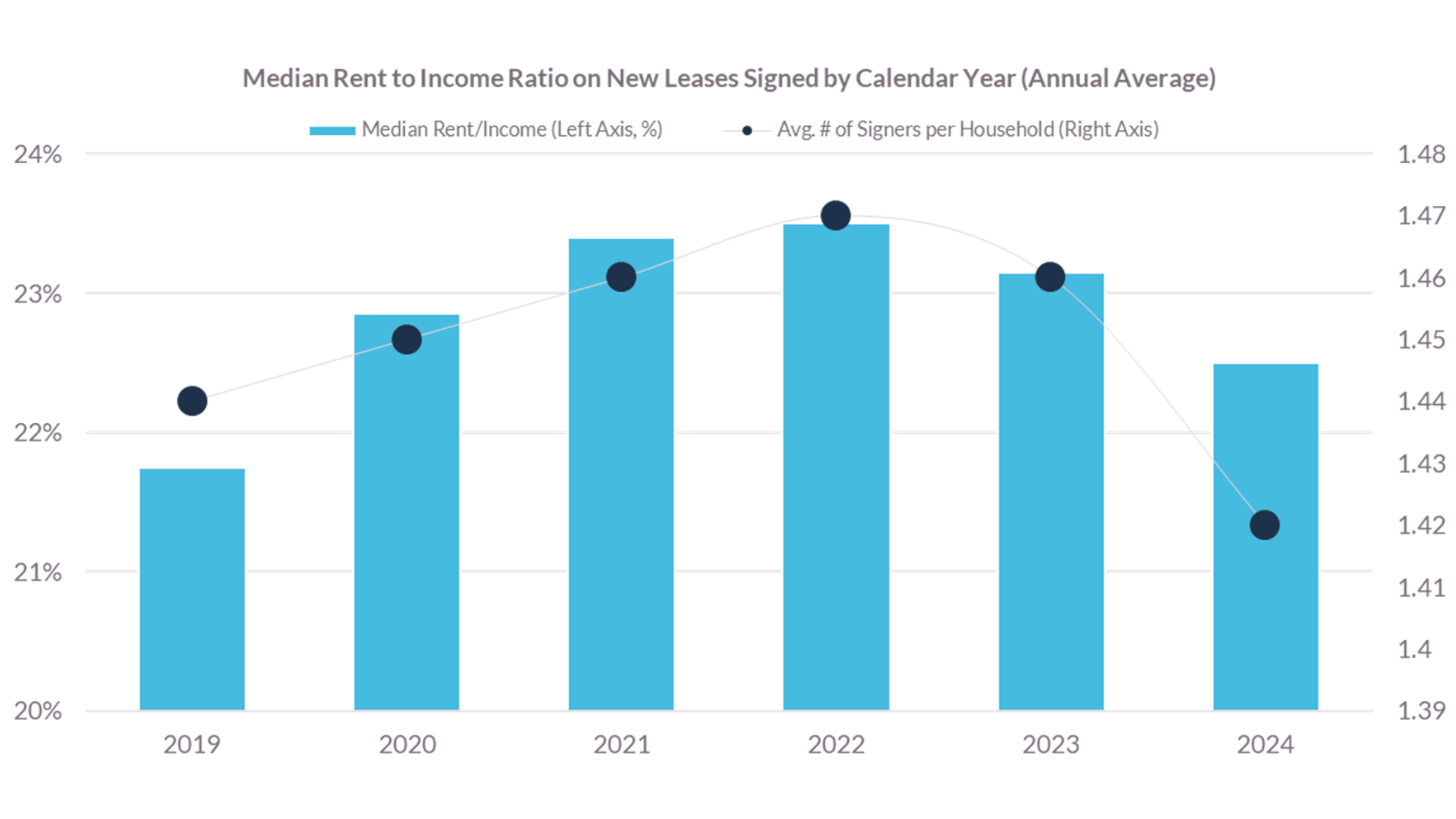

Wage growth has emerged as a more reliable indicator of demand. It has consistently outpaced historical averages and largely kept pace with rent increases. Despite significant rent hikes in 2021 and 2022, affordability has remained stable for market-rate apartment renters. Rent-to-income ratios show that renters, on the whole, have absorbed these increases without widespread financial strain.

Source: RealPage

In 2024, the number of residents per household dropped to its lowest level since the mid-2010s, countering concerns that economic pressures would lead to more renters doubling up. This indicates a continued preference for independent living, which further supports apartment demand. Additionally, rising consumer confidence, driven by easing inflation, typically signals increased apartment demand. This suggests that demand will strengthen through 2025, even if job growth doesn’t fully drive the market.

The Influence of the Single-Family Housing Market

Affordability challenges in the single-family housing market are also playing a major role in rental demand. Home prices have increased at a far greater rate than apartment rents, making homeownership increasingly out of reach for many renters. As a result, fewer renters are making the leap into homeownership, keeping apartment occupancy rates stable.

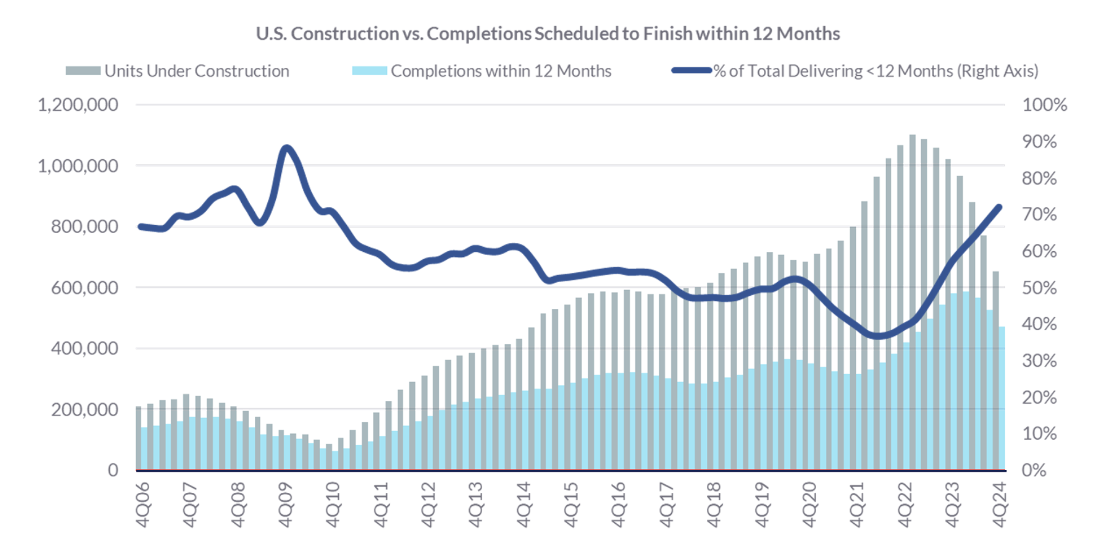

Supply Trends: A Peak Behind Us

On the supply side, the apartment market is coming off a record-setting year for new deliveries. In 2024, more units were delivered than in any year since the mid-1970s. However, this construction peak is now in the rearview mirror. By 2026, new apartment deliveries are expected to drop to their lowest levels since the mid-2010s.

This supply slowdown is expected to shift market dynamics. While 2025 will likely be a year of occupancy stabilization, 2026 could mark a turning point where rent growth accelerates once again due to tightening supply. With demand holding steady and new supply shrinking, rental market fundamentals are poised to strengthen in the coming years.

Source: RealPage

Looking Ahead

The real estate market in 2025 will be shaped by evolving demand drivers, affordability challenges in homeownership, and a slowdown in new apartment deliveries. As highlighted by RealPage insights, traditional indicators like job growth are no longer enough to predict market movements. Instead, wage growth, consumer confidence, and trends in housing affordability offer a clearer view of what’s ahead. For renters, the market’s stability presents continued opportunities to secure housing without the dramatic price surges experienced in previous years.

For investors looking to capitalize on these market trends, Roers Cos. offers a distinct advantage. With a proven track record of identifying high-growth markets and executing successful multifamily developments, we are well-positioned to navigate the evolving real estate landscape. Our strategic approach focuses on high-demand regions where supply constraints create strong rental income potential.

Roers Cos. prioritizes data-driven decision-making, using market insights to optimize returns while managing risk. Our focus on high-quality developments, strong resident demand, and disciplined financial management supports stable cash flow and long-term value appreciation. As 2025 unfolds, partnering with Roers Cos. offers an opportunity to invest with confidence in a firm that understands the nuances of the market and is well-equipped for continued success in the multifamily sector.

To learn more about investing in multifamily real estate with Roers Cos. and explore opportunities to expand and diversify your portfolio, please contact your investor relations professional or contact the investor relations team here.

Sources: RealPage – Carl Whitaker

Date Published 4/10/2025

NO OFFER OF SECURITIES; DISCLOSURE OF INTERESTS: NO INFORMATION OR MATERIAL CONTAINED HEREIN MAY BE USED OR CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION OF ANY OFFER TO BUY AN INTEREST IN ANY INVESTMENT. ANY SUCH OFFER OR SOLICITATION WILL BE MADE ONLY BY MEANS OF A CONFIDENTIAL PRIVATE PLACEMENT RELATING TO THE PARTICULAR INVESTMENT. Access to information about investments with projects undertaken by Roers Companies LLC, Roers Companies Project Holdings LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results.

NO OFFER OF INVESTMENT, LEGAL OR TAX ADVICE. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment you should consult with a licensed investment, financial advisor, legal and tax advisor.

Current Investment Opportunities

Investment opportunities for new multifamily projects are now open.