Stocks, Bonds, and Real Estate Asset Volatility and Performance Comparison

Stability vs. Returns

Savvy investors know that diversification is key to overall portfolio performance. Recent economic

headlines on inflation, interest rates, and bank instability have led many individuals to pull back from new investments. Historical data shows us that those who seek out stable investment opportunities in uncertain market conditions — such as multifamily real estate — experience less volatility and greater long-term growth potential.

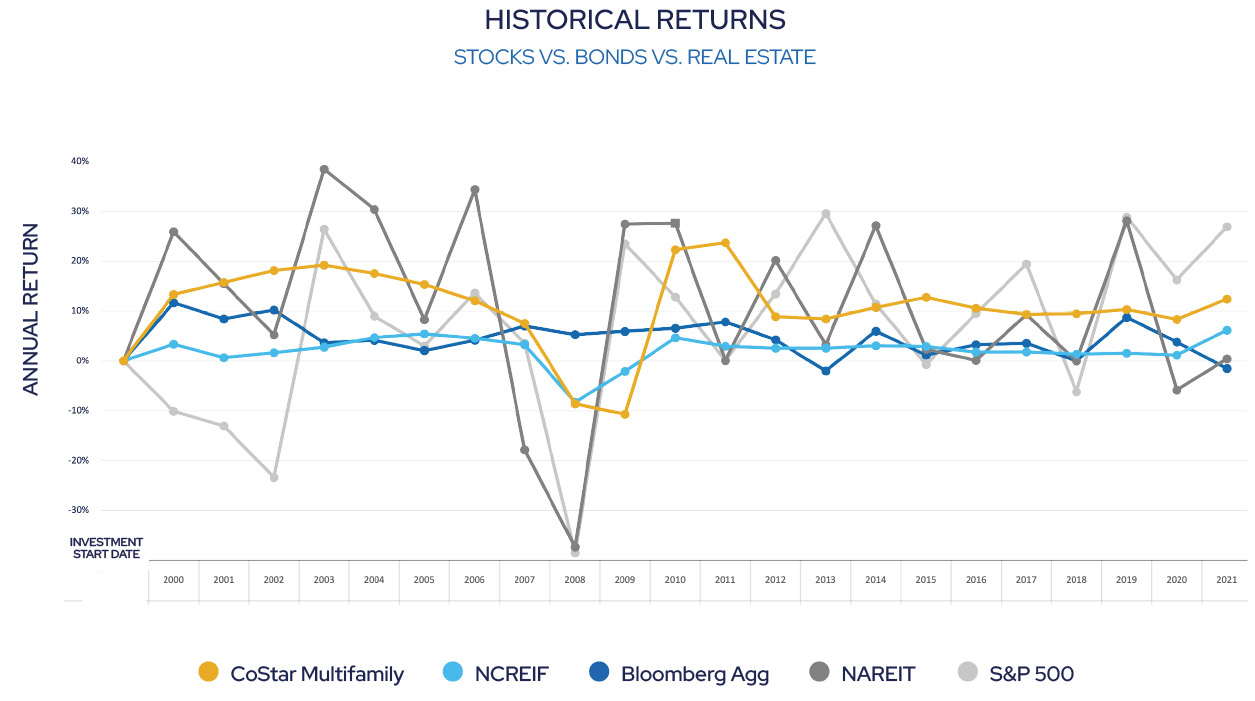

Volatility Comparison

Publicly traded investments tend to have more risk

By comparing annual returns since 2000 across stocks (S&P 500), bonds (Bloomberg Agg.), public real estate trusts (NAREIT), private commercial real estate (NCREIF), and multifamily real estate (CoStar Multifamily), it’s clear that some are more volatile than others. While stocks and publicly traded REITs do boast some of the highest historical highs, they also experienced the most extreme losses during the Great Recession and saw significant volatility throughout the past 20+ years.

Multifamily real estate investments offer less volatility than stocks and REITs, are not correlated to the stock market, and offered better annual returns than bonds in all but two years since 2000.

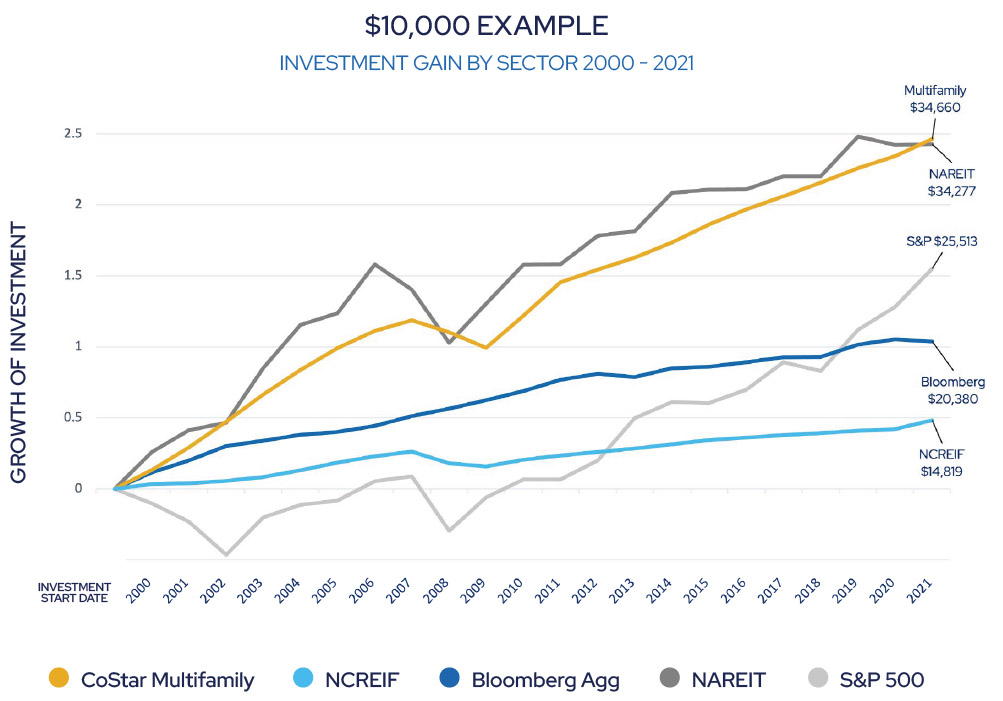

Performance Comparison

Comparing $10,000 investment performance

If you compare the performance of a $10,000 investment made in the year 2000 over time, you can see that the growth in multifamily outperforms other asset types, while offering greater stability than typical stocks or REITs.

Most investors will benefit from a diverse portfolio with a mix of high-growth and stable investment types. If private multifamily investments aren’t part of your asset mix, it might be time to revisit your strategies.

SOURCES:

“CoStar”

“REIT Data.” Nareit, May 8, 2023. https://www.reit.com/data-research.

“S&P 500 Historical Annual Returns.” MacroTrends. Accessed May 5, 2023. https://www.macrotrends.net/2526/sp-500-historical-annual-returns.

Thompson, Michael. “Bloomberg US Aggregate Bonds Annual Returns.” UpMyInterest. Accessed May 5, 2023. https://www.upmyinterest.com/bloomberg-us-aggregate-bonds/.

“U.S. NCREIF Property Index Returns 2022.” Statista, February 23, 2023.

NO OFFER OF SECURITIES; DISCLOSURE OF INTERESTS: Under no circumstances should any material on this flyer be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the confidential Private Placement Memorandum relating to the particular investment. Access to information about investments with projects undertaken by Roers Companies LLC, Roers Companies Project Holdings LLC, or any of their respective affiliates is limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who are generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments. Investment outcomes vary. Past success does not guarantee future results. Historical return details available.

Current Investment Opportunities

Investment opportunities for new multifamily projects are now open.