Economic Outlook and Impact on Multifamily

The U.S. economy is facing a number of challenges including high inflation, rising interest rates, and a downgrade of the country’s credit rating. However, business leaders should not be alarmed by these headlines. A similar downgrade occurred in 2011, and while market dynamics are different to then, these developments are most commonly associated with the back side of the natural economic cycle. When this cycle resets, the challenges above tend to lessen and allow for a more suitable business environment.

The U.S. Real Gross Domestic Product (GDP) in the second quarter came in 2.6% above the prior year, though this is lower than the first quarter of 2023 which showed a GDP growth of 3.2%. This means that the total output of goods and services produced in the U.S. in the second quarter was 2.6% higher than it was in the second quarter of the previous year, but growth is slowing down.

Currently, the yield on short-term bonds is higher than the yield on long-term bonds. This causes an inverted yield curve, which is often seen as a sign of a near-term recession; however, this is not necessarily a signal of a steeper-than-anticipated recession. The 2024 recession is expected to be mild, and the overall financial sector remains resilient. The housing market is a leading indicator of the economy, which means that it tends to change before the rest of the economy by roughly one year. If the housing market is recovering, it is likely that the rest of the economy will follow suit in late 2024, and we’re already seeing positivity from the housing market. Recovery in the residential construction sector bodes well for the broader economy in late 2024. Despite these challenges, the multifamily real estate development and construction industries are also likely to see signs of economic recovery in late 2024.

Reports in June 2023 showed annual private multifamily residential construction rose to 13.7% year-over-year. While we are currently in a challenging environment the data is suggesting that the demand for multi-family housing remains strong. Our team is seeing this first-hand with occupancy rates at 95% and rental rates increasing 3-4% on average. There are a number of factors that are contributing to the robust demand for multifamily housing, including the rising cost of homeownership. As the cost of buying a home increases, more people are choosing to rent.

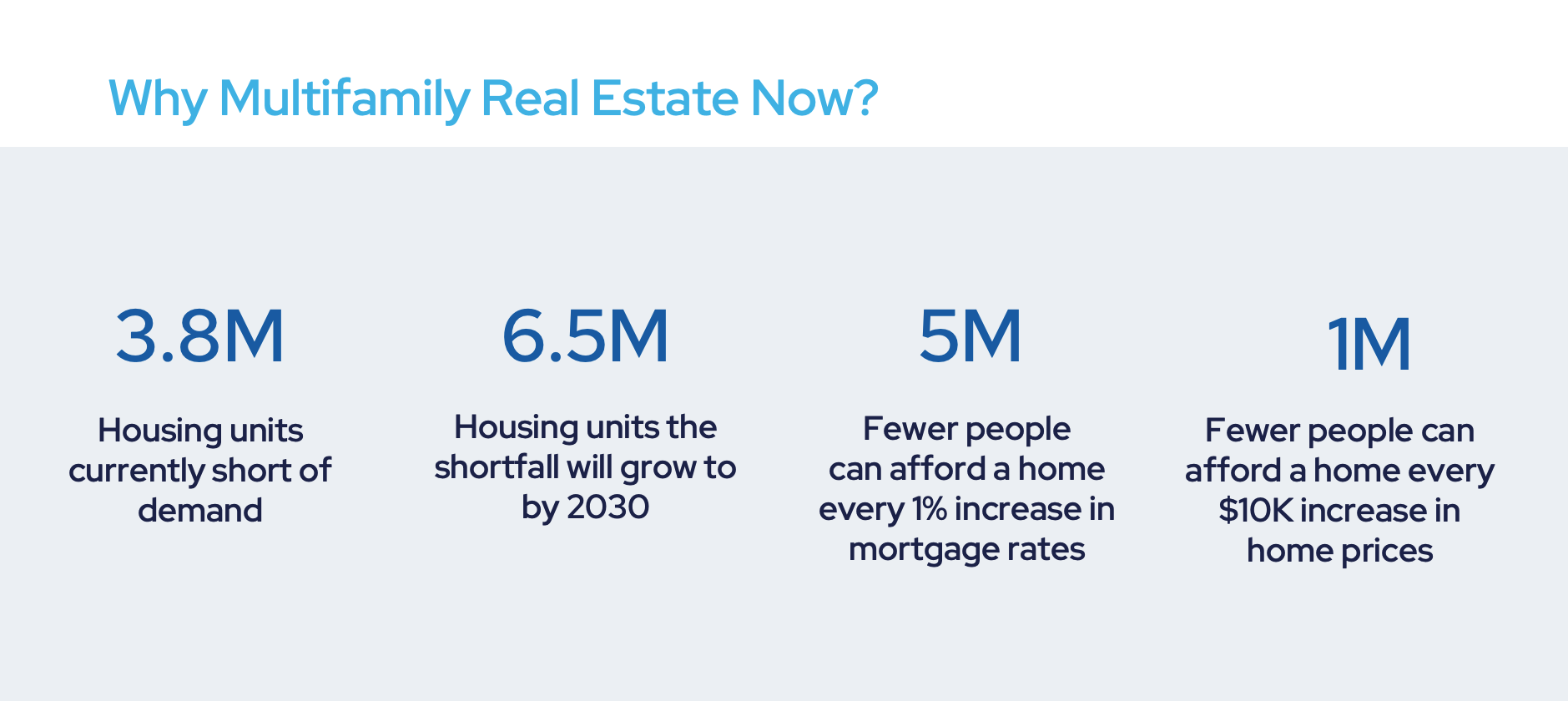

The U.S. is shy of demand by nearly four million housing units across the country, and at the current pace homes are being built, this trend will continue to grow to six and a half million by 2030. With rising interest rates spelling trouble for single-family buyers and declining accumulated savings from consumers, multifamily rentals are well-positioned to attract residents.

Whether relief from this environment comes in the near-term or long-term, Roers Cos. continues to plan for any obstacle ahead. To prepare, Roers Cos. is:

- Securing financing & strengthening our client relationships

- Reducing costs by negotiating better prices for materials and labor

- Focusing on projects that are backed with strong quantitative assumptions

As the political season heats up, expect to see more headlines about the economy. But don’t let these headlines fool you. Economic fundamentals are still strong, even if the headlines don’t always reflect that.

Should you have any questions or wish to delve deeper into Roers Cos. investment options, please don’t hesitate to contact our team. We would be happy to answer any questions you have and help you get started.

Sources: ITReconomics.com

NO OFFER OF INVESTMENT, LEGAL OR TAX ADVICE. The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment you should consult with a licensed investment, financial advisor, legal and tax advisor.

Current Investment Opportunities

Investment opportunities for new multifamily projects are now open.