Cities vs. Suburbs: Why Multifamily is Thriving Outside the Urban Core

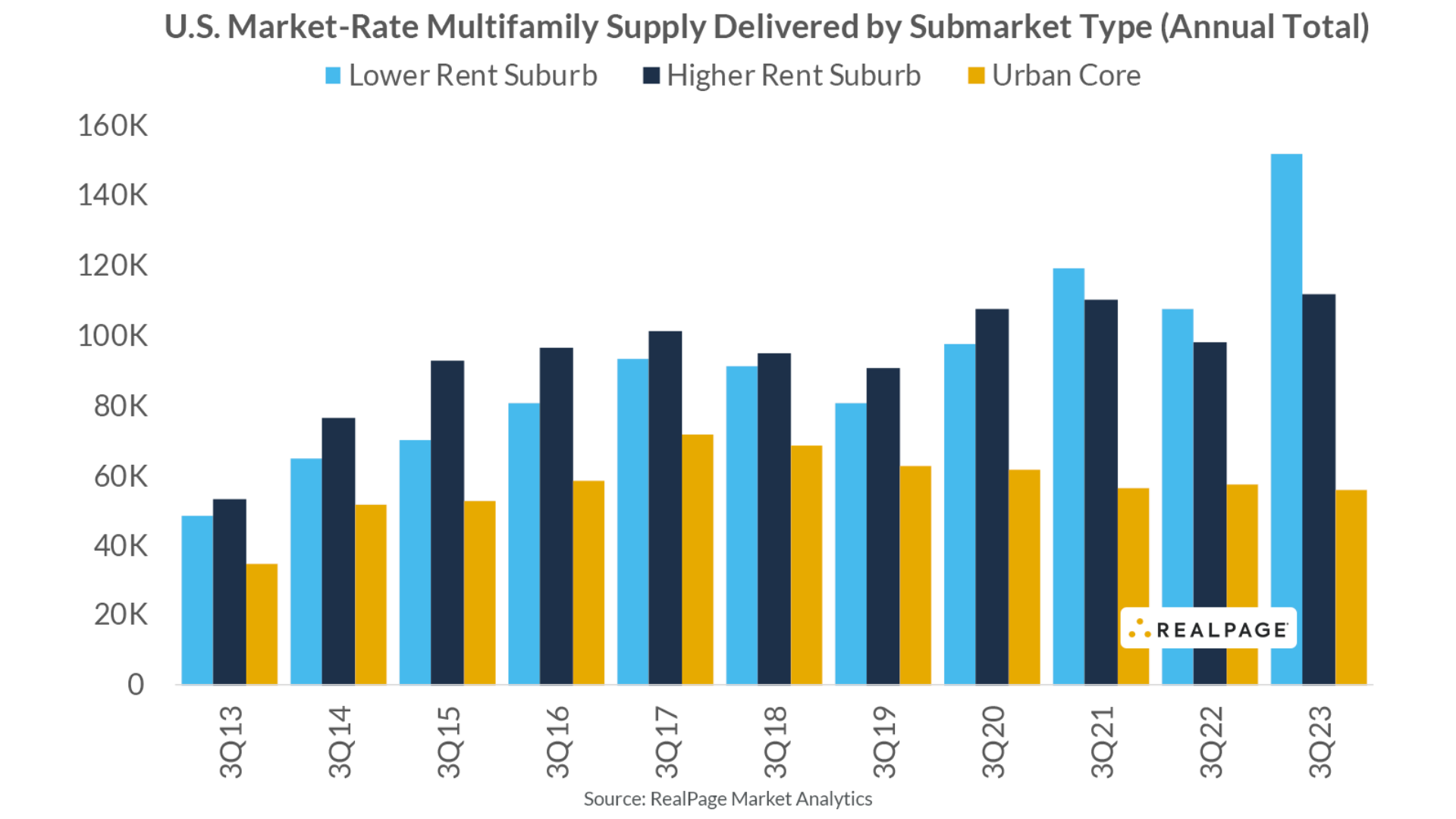

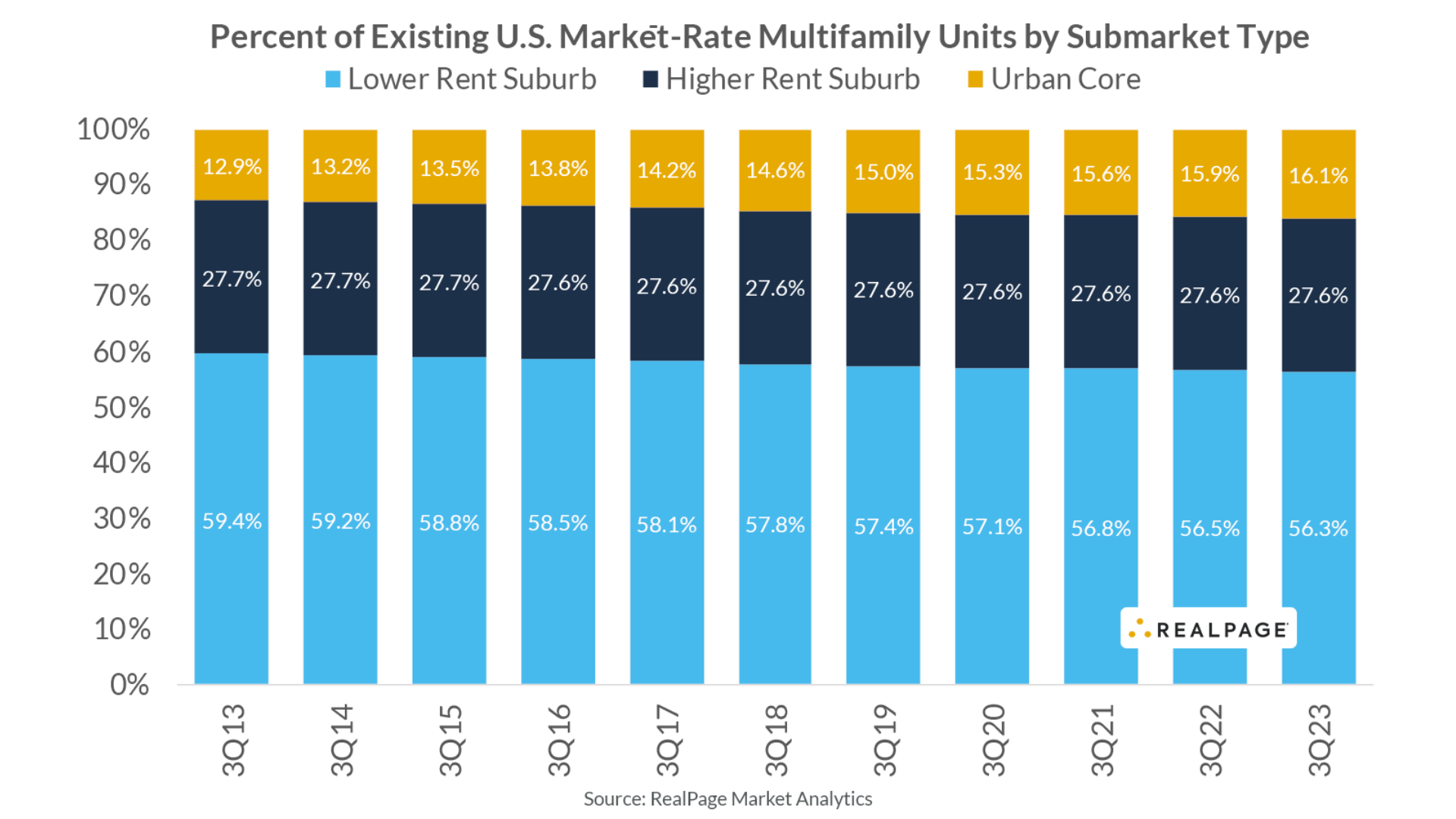

Traditionally viewed as a secondary market, suburban multifamily properties in lower-density areas surrounding cities are experiencing significant growth, outperforming their urban counterparts in densely populated cores.

Suburban rentals are booming as affordability and space draw renters. This surge fills vacancies faster and hikes rents quicker than in cities. For investors, cheaper suburban properties offer strong cash flow, competing with pricier urban markets focused on long-term appreciation.

Suburban Appeal

Demographic shifts are fueling the suburban multifamily boom. A more affordable housing option, coupled with more spacious living arrangements in the suburbs are two key attributions to the draw of the suburbs. Young families are priced out of ever-increasing urban housing costs. Zillow reports urban rents continued to rise in February 2024, with a 3.5% increase compared to the same month last year. This trend is further reinforced by the prevalence of remote work, which releases professionals from the confines of city centers. According to McKinsey Global Institute, 15% of employees work exclusively from home while 30% work a hybrid schedule — part-time in the office and part-time from home. As a result, suburban apartments are experiencing a surge in demand, tightening vacancy rates, and driving rental prices upward. The typical profile of a suburban renter is experiencing a dramatic transformation.

The increasing availability of amenities in suburban areas creates a more well-rounded living experience, attracting those who prefer the convenience and social aspects of apartment living without sacrificing the benefits of a suburban setting. Access to good schools is a significant factor for families with children. This shift in preferences is creating a robust market for suburban multifamily housing, catering to a broader range of renters seeking affordability, space, and a more relaxed lifestyle.

Investment Advantages

The appeal of suburban multifamily investments is undeniable. Suburban multifamily features a stable resident base with potentially lower vacancy rates. Investors in these high-demand neighborhoods can benefit from less downtime between renters and a more consistent cash flow.

As demand rises, vacancy rates decrease and rental prices soar, offering investors the opportunity for greater rental returns compared to urban properties. This strong market performance is further enhanced by the advantage of lower initial investment expenses.

Suburban properties typically cost less to build than urban ones, making them a more accessible entry point for investors, particularly those new to the market or with limited capital. Furthermore, suburban markets often boast higher rental yields, meaning the return on investment can be more attractive for investors seeking strong cash flow. This combination of strong rental growth, lower acquisition costs, and potentially higher yields makes suburban multifamily a strategic option for investors seeking to maximize their returns.

How Roers Companies is Capitalizing on This Market Shift

Roers Cos. is leveraging suburban markets through mixed-use development and building properties that cater to local demographic trends and remote workers. These developments seamlessly integrate residential units with retail shops, offices, and luxurious amenities like pools and coworking spaces, creating a dynamic and multifaceted living experience. This approach caters directly to the growing desire of urban residents for an accessible, amenity-rich lifestyle. By keeping everything close by, residents can experience a greater sense of convenience and community within their own neighborhood.

Roers Cos. has established itself as a leader in suburban multifamily development. Projects like Axle Apartments, a “workforce” community designed at an accessible price point for the average worker, have significantly boosted our portfolio’s success. Additionally, the highly anticipated Maplewood development, Oberon, will provide a diverse range of housing options.

By prioritizing affordability, top-notch amenities, and strategic locations, Roers Cos. helps meet the rising desire for suburban living. Our proven success sets us up to further seize this trend and influence the future of suburban multifamily housing.

To learn more about Roers Cos.’ properties and potential investment opportunities, please contact our investor relations team or visit our website.

NO OFFER OF SECURITIES; DISCLOSURE OF INTERESTS: Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment. Access to information about investments with projects undertaken by Roers Companies LLC, Roers Companies Project Holdings LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results.

NO OFFER OF INVESTMENT, LEGAL OR TAX ADVICE. The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment you should consult with a licensed investment, financial advisor, legal and tax advisor.

Current Investment Opportunities

Investment opportunities for new multifamily projects are now open.