Why Invest in Multifamily in South Carolina

28k+ Jobs Added Since 2022

Governor McMaster indicates the number of new jobs incorporated into the economy doubled in 2023

South Carolina’s thriving economy — with 14,000 new jobs added in 2023 — presents a lucrative opportunity for investing in multifamily real estate. This significant growth builds upon the 14,000 jobs that were previously added in 2022, showcasing a promising trend of economic expansion. The job growth leads to a larger tenant pool, higher occupancy rates, and potential rental income growth.

Population Growth Outpaces National Average

South Carolina’s population grew 14% from the 4.6 million people who lived there in 2010

South Carolina’s booming population presents a compelling opportunity for investors in multifamily real estate. The state’s population growth has outpaced the national average for over a decade, reaching a staggering 14% increase since 2010. This rapid influx of residents has significantly impacted the housing market, fueling a rise in home prices and a scarcity of available homes. This trend translates into a significant advantage for multifamily real estate investors.

Doubling Home Prices Layer Onto Multifamily Demand

Home prices in South Carolina have increased by almost 50% since 2020

The surge in demand and limited inventory are driving up home prices, making homeownership challenging for middle-class South Carolinians. As homeownership becomes less attainable, the need for rental units increases. Investors in multifamily properties are well-positioned to capitalize on this growing demand, offering much-needed housing options to a population with limited choices.

Business-Friendly Tax Regulations

South Carolina is an attractive location for companies looking to minimize their tax burden

South Carolina boasts a business-friendly tax environment with a low flat corporate income tax rate of 5%. This, combined with the absence of various taxes like state property tax, inventory tax, and sales tax on certain manufacturing materials, keeps business costs down. The state further incentivizes business growth by offering tax credits for job creation, investment in new equipment, and even headquarters relocation.

Invest in South Carolina

Marlowe — Charlotte Metro Apartments

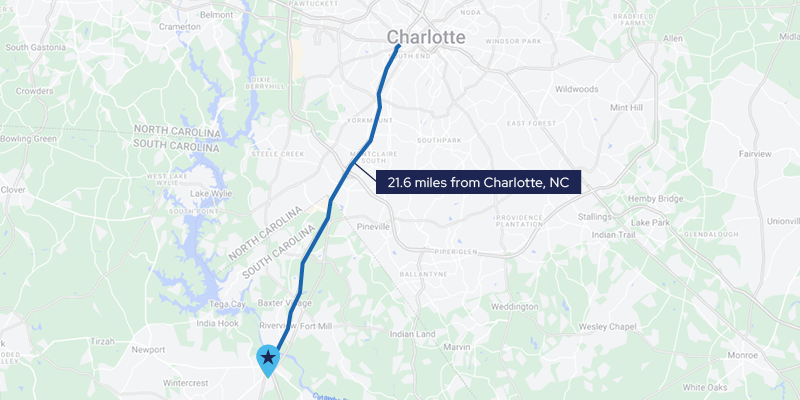

Roers Companies is proposing the new construction of a high-quality 196-unit, 55+ mixed income apartment building located in Rock Hill, South Carolina nearby the major metro of Charlotte, North Carolina. Offering both affordable and market-rate units can address a wide range of seniors, from those on fixed incomes to those looking for more upscale living options. This mix can enhance the 55+ community’s diversity and vibrancy while fulfilling a broad spectrum of housing needs. This four-story project will offer a variety of unit types ranging from one to two-bedroom, featuring premium amenity spaces including a swimming pool, fitness center, and club room.

Project highlights:

Proximity to Charlotte, NC — Rock Hill’s proximity to Charlotte, combined with its own local amenities and services, makes it an ideal location for seniors who want the best of both worlds: the tranquility of suburban life with easy access to urban conveniences and healthcare facilities. The Charlotte Region is home to 18 companies on the Fortune 500/1000 list, making it a top destination for businesses of all sizes. With a population of nearly one million residents within the city limits, 2.8 million in the metropolitan area, and 7.8 million within a 100-mile radius, Charlotte ranks fifth on the U.S. News & World Report’s “Best Place to Live” list.

Area Demand — Rock Hill stands out with a significant population of residents aged 55 and over, making it the focal point of York County. Currently, 26% of Rock Hill’s population falls within the 55+ age group, a number that is projected to climb even higher, reaching 34,097 people by the year 2027. Despite the growing demand, the availability of suitable housing is limited, with only four vacancies among the 407 affordable units in the Rock Hill submarket. This scarcity highlights a clear market gap that our mixed-income senior housing project aims to address effectively.

Mixed-Income Appeal — Offering affordable and market-rate units can address a wide range of seniors, from those on fixed incomes to those looking for more upscale living options. This mix can enhance the 55+ community’s diversity and vibrancy while fulfilling a broad spectrum of housing needs.

Unique Financing — By capitalizing on a state program that grants tax exemptions for mixed-income housing projects, Roers Cos. can effectively lower our operational costs, increasing confidence in strong returns for investors while also meeting the urgent need for affordable housing in the Charlotte area.

NNO OFFER OF SECURITIES; DISCLOSURE OF INTERESTS: Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment. Access to information about investments with projects undertaken by Roers Companies LLC, Roers Companies Project Holdings LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results.

NO OFFER OF INVESTMENT, LEGAL OR TAX ADVICE. The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. Prior to making any investment you should consult with a licensed investment, financial advisor, legal and tax advisor.

Sources: GSA Business Report, South Carolina Department of Commerce, USA Facts

Current Investment Opportunities

Investment opportunities for new multifamily projects are now open.