Why Invest in Multifamily in Minnesota

Over the past seven years, Roers Companies has built a portfolio of 27 developments in Minnesota. In those 27 projects, Roers Cos. investors have seen an average annual return of 35.1% on sold properties and 9% annual income on existing operating assets.

- 16th Largest metro in U.S. with 3.7 million people

- #1 state for Fortune 500 headquarters per capita

- Top employers: United Health Group, Target, Best Buy

7,500 Minneapolis Metro Units Absorbed

Demand for apartments remained steady throughout the Midwest in 2022. The Minneapolis metro absorbed 7,500 units—more than any U.S. Sun Belt market.

Source: CoStar

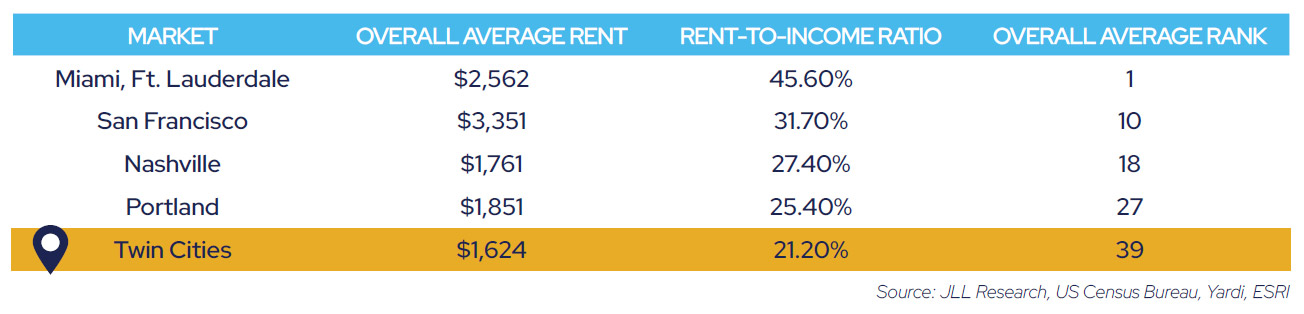

Rent-to-Income Ratios – Top 40 U.S. Markets

The Twin Cities is home to a population of renters who can afford rent growth, which propels investor returns. In the table below, we’ve highlighted a few top markets from an analysis of the 40 most populated U.S. markets.

35.1% Average Realized IRR in Minnesota

Roers Companies’ 12 Minnesota property sales to-date have averaged a 35.1% realized IRR for investors.

Current as 06/05/2023

NO OFFER OF SECURITIES; DISCLOSURE OF INTERESTS: Under no circumstances should any material or information contained herein be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of a confidential offering memorandum relating to the particular investment. Access to information about investments with projects undertaken by Roers Companies LLC, Roers Companies Project Holdings LLC, or any of their respective affiliates is limited to investors who qualify as accredited investors within the meaning of the Securities Act of 1933, as amended. Investment outcomes vary. Past success does not guarantee future results. Historical return details available.

The material contained herein is general information for educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

Current Investment Opportunities

Investment opportunities for new multifamily projects are now open.